Your Guide to Offerpad: Reviews, Pros, Cons, & Fees

iBuyers have grown to be a large segment in the real estate transaction market. One prominent iBuyer company, Offerpad, promises homeowners the opportunity to sell their home quickly and easily. However, this convenience may come at a cost with service fees sometimes running as high as 10% (far more than even a traditional real estate agent).

Despite this high price, Offerpad may still be a solid option for sellers who are looking to move quickly and aren’t too worried about leaving money on the table. Read on to hear various Offerpad reviews, our analysis of the company, and various pros and cons to using the service.

What is Offerpad?

Offerpad is an iBuyer – a technology-driven real estate company, that in its simplest terms behaves like a very well funded real estate investment firm. They purchase homes all over the country with the intention of improving the value and then re-selling for a profit.

This business model may not sound like an earth shatteringly different idea. This is the same basic principal that your average real estate investor uses. The technology, systems and processes, scale, and speed are the main differentiators for Offerpad.

Unlike other similar cash investors, Offerpad boasts a hybrid model that combines data and algorithms as well as in house local market experts to arrive at the ‘fairest’ price. Of course, the ‘fairest’ price for both sides may not always be the highest, and is often often lower than what would be offered in a conventional sale.

It is important to consider that while Offerpad can lead to a quick and easy sale, home-sellers will very likely be giving up money for this convenience.

How Does Offerpad Work?

Offerpad leverages a massive marketing budget that attracts home sellers nationwide to request quick cash offers on Offerpad’s site. Other traditional real estate investors face the challenge of tracking down distressed property owners who may be in financially compromising situations or may not be able to maintain/repair their home.

This can be challenging because they are hunting down below market deals with plenty of meat on the bone to fix up and then sell for a profit. Lead generation is often a significant problem for the average real estate investor.

Offerpad on the other hand, leverages a massive marketing budget across television, radio and social media to drive large amounts of traffic to their site. In essence, Offerpad as a company is more of a farmer of leads that come to them.

This can create a huge competitive advantage with new potential deals are coming to them in waves. They simply have to provide the bandwidth to properly analyze and vet the thousands of offer requests they receive weekly.

Selling with Offerpad consists of 5 straightforward steps:

- Offer Request

- Offer Sent

- Offer Accepted

- On Site Inspection

- Closing

Let’s take a closer look at each of these steps.

Offer Request

A home seller interested in selling to Offerpad starts by visiting their website and going through a series of fairly simple steps to provide Offerpad the information necessary to make a decision on an offer.

This info consists of basic property info such as beds, baths, square footage, number of stories, age, quality of finishes, and pictures of the home.

Certain homes are not eligible to receive Offerpad offers (this list can change at their discretion):

- Non-single family homes (no mobile homes or trailers).

- Homes built prior to 1960.

- They will have a price floor and price ceiling that can change based on the market they are buying and selling within.

- Less than one acre lots.

Offer Calculation

If your home qualifies, Offerpad will have one of their “market experts” determine the market value and decide what Offerpad is willing to offer.

They will then prepare a written offer using contracts that are normal to their respective market, along with several Offerpad addendums. These include some specialized terms outlining their purchase requirements and fee structure.

Even if you are working with a listing agent to help you sell the property, you can still request an offer from Offerpad. Due to the fact Offerpad is a legal brokerage, they must comply with state laws and will likely send everything directly through your agent.

Offer Acceptance

If the terms of the offer meet the seller’s expectations, they sign the contracts electronically creating an executed and enforceable contract.

Keep in mind once you accept their offer and sign the contract you are locked in. This is not a scenario where you can continue to fish for other buyers or market the property. Only accept an Offerpad offer if you are ready to honor the agreement.

Offerpad can offer a flexible closing date or even move out time frame. However, make sure this is encapsulated in the agreement before you sign.

Home Inspection

Once you have accepted an offer from Offerpad, there are still many things that can potentially de-rail the transaction, so don’t count your chickens before they hatch.

Remember, when your offer is accepted, chances are nobody from Offerpad has actually stepped foot on the property yet. So far this has been a completely virtual experience. Once the contract is accepted however, an Offerpad representative will come to the property to perform an inspection with their professional inspectors or contractors.

They will have the ability to back out of the contract or try to re-negotiate if the on site inspection uncovers things that previous stages of the process did not uncover. It will be up to you as the seller if you decide to move forward with any changes to the agreement.

Closing

If everything goes to plan, you will reach the closing table. You will likely be using Offerpad’s title company as this is an affiliated business (and additional source of revenue) of Offerpad. You will sign the proper paperwork, funds will be disbursed to you, and the deal is over.

Offerpad Locations

Currently Offerpad only buys homes in 17 markets, mostly based in the Southwest and Southeast:

- Birmingham, AL

- Phoenix, AZ

- Tucson, AZ

- Denver, CO

- Jacksonville, FL

- Orlando, FL

- Tampa, FL

- Atlanta, GA

- Indianapolis, IND

- Las Vegas, NV

- Charlotte, NC

- Raleigh, NC

- Nashville, TN

- Austin, TX

- Dallas/ Fort Worth, TX

- Houston, TX

- San Antonio, TX

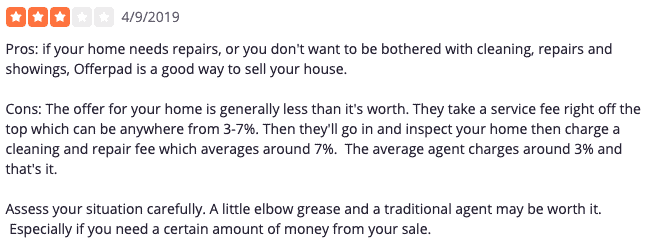

Offerpad Fees

Most people assume that Offerpad’s revenue comes predominantly on the difference between the price they purchase homes for and the price they ultimately resell it for. This is only partly true.

So far, Offerpad hasn’t proven they can do this part very well. Many real estate professionals will analyze their deals and the math just doesn’t work out. They seem to pay too much for homes and not sell them for enough to be able to turn a reasonable profit.

Mike Del Prete, a leading real estate economist and professor, is the one of the leading analysts when it comes to the iBuyer model. If you have follow his site, www.mikedp.com, you will learn they are nowhere near being profitable yet.

Offerpad is spending gobs of cash in the iBuyer land grab to gain market share, with profitability as a far distant goal. With billions in Wall Street money, this is an advantage that your average investor will never have. Where Offerpad hopes to be able to decrease losses and eventually turn a profit is through fees and secondary services.

Fee Breakdown

- Service fee charged to the seller: This ranges from 5% to as high as 10% depending on the property, location and terms of the offer. The average fee tends to be 7%.

- Title and escrow fees: Offerpad will have you use their title company. This doesn’t cost you anything extra (because you need to close at a title company anyway), but it brings in extra revenue for them.

- Mortgage: They will try to have you use their mortgage services on a new home you may buy

Offerpad Pros and Cons

Pros

- Speed. They are fast, sometimes closing in as little as a week to 10 days.

- Convenience. Sellers don’t have to worry about repairs or staging their home for the market.

- Flexibility. Offerpad is often generous with their closing or move out dates.

- Ease. Their platform makes it easy to request, receive, sign and execute a contract. There are not any third party middle men that can make things complex.

Cons

- Expensive. Paying 7-10% is more than you would pay a traditional realtor to sell your house.

- Reduced profits. By selling straight to Offerpad, you run the risk of leaving money on the table because you don’t get to test the open market which can bring you bidding wars that may drive your price 10’s of thousands of dollars above what Offerpad would pay you.

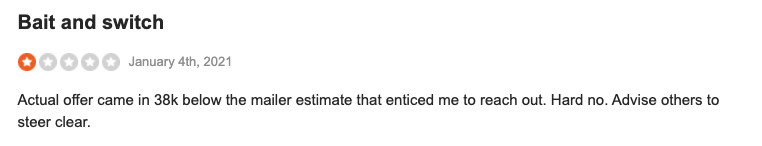

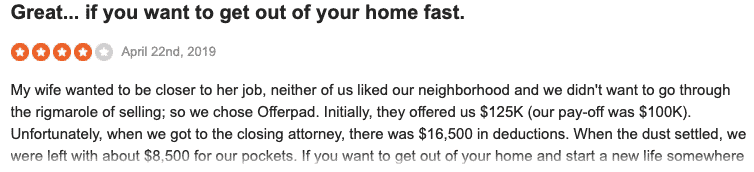

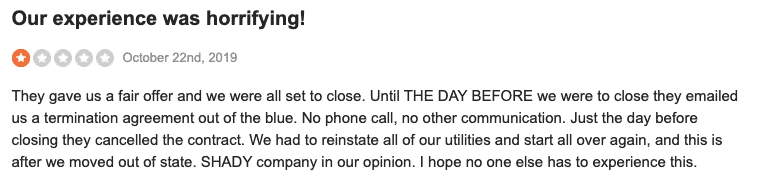

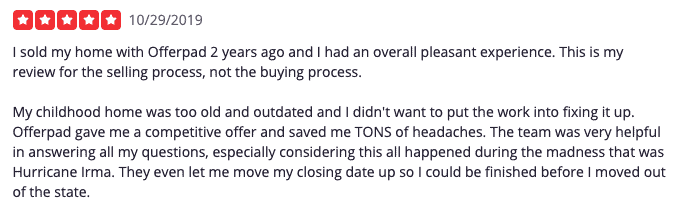

- You get let down. Offerpad will not buy every house they get under contract, often times a seller will get their hopes up and then Offerpad will come back with a large price drop or concession after the in person inspection or they decide to back out of the deal all together.

Offerpad Reviews

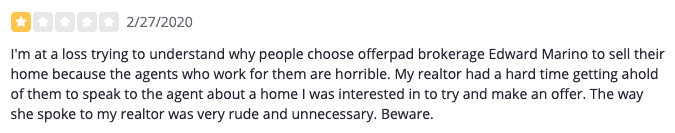

Sitejabber: 2.18 Stars out of 5 based on 38 Reviews

Yelp: 1.5 Stars our of 5 based on 25 reviews

Better Business Bureau: 2.72 Stars our of 5 based on 46 reviews

Think about ListingSpark if you want a better way to sell

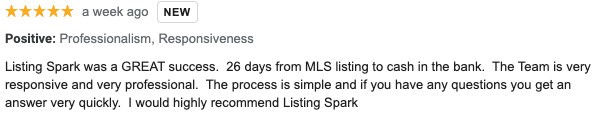

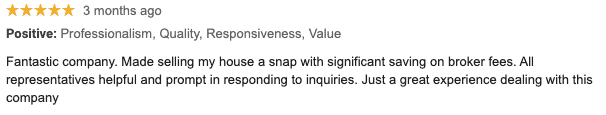

With ListingSpark, you don’t pay any of those crazy high real estate commissions or the bloated fees charged by the iBuyers. Instead you get the highest quality listing with all of the top tier tools real estate professionals use to bring you top dollar on the open market.

The average ListingSpark seller saves over $10,000 in commissions and often times lands multiple offers in the first week of listing. No leaving money on the table or wondering what you may have been able to get if you didn’t sell to an investor.

Recognized by Real Trends as one of the premier options to list and sell your home in Texas, ListingSpark is the best option for sellers trying to maximize profits with a simple and easy home selling process.

What are clients saying about ListingSpark

The Bottom Line

Offerpad may be the right option if you need to sell your home quickly and don’t mind leaving some money on the table. High service fees or a low offer may eat into your profits, but if you need to sell fast, the convenience of Offerpad may be worth considering.

Related Posts

Selling a House Without a Realtor: Hidden Costs & Risks

When homeowners consider the risks of selling a house without a realtor, they often focus solely on potential commission savings. However, FSBO homes sold for a median of $380,000 in 2024, compared to $435,000 for…

Do You Need a Realtor to Sell a House?

The latest data from the National Association of Realtors shows that 90% of home sellers use agents, but this raises an important question: Do you need a realtor to sell a house? While the majority…

2025 Texas Real Estate Housing Report: Market Trends, Prices, and Forecasts

The Texas real estate landscape continues to evolve as we move through 2025, presenting both opportunities and challenges for buyers, sellers, and investors across the Lone Star State. This comprehensive 2025 Texas Real Estate Housing…